Slaying the Incumbent: Roblox

The UGC toybox that became the most powerful platform in gaming.

Slaying the Incumbent is a series about analysing genre kingpins: how did they get there, what makes them so dominant, and how can they be dethroned.

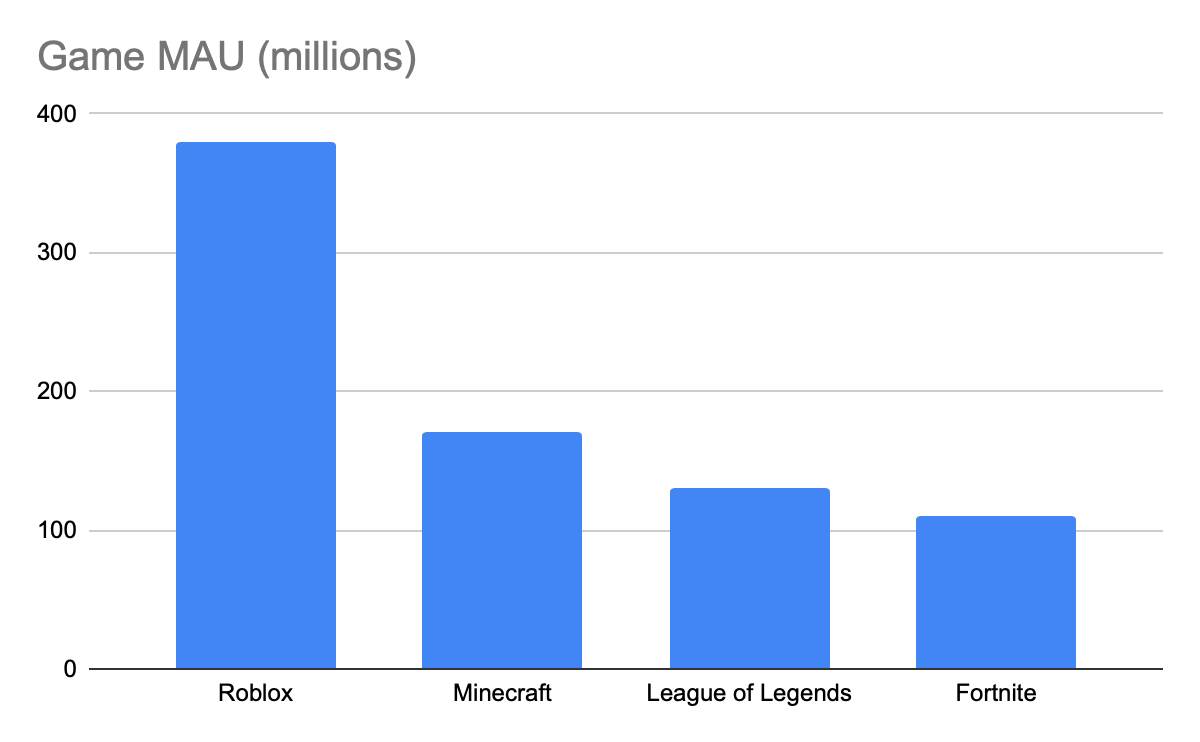

If Roblox is a game, it’s the most played game on the planet. If Roblox is a platform, it’s the most used dedicated gaming platform on the planet. A Roblox player has over 40 million games at their disposal. Last year, Roblox generated over $3.6 billion in revenue across 40 million+ games, most of which were created by independent teams. In an industry where GTA V, Fortnite, and Minecraft are heralded as games-as-a-platform titans, Roblox quietly became the juggernaut platform in the video game industry.

Despite these numbers, it’s often left out of strategy decks because it looks like a toy to those judging production values alone. How did Roblox dominate the UGC game industry? Why isn't Roblox the gold standard for platform design, UGC scale, or ecosystem economics? And most importantly, who can dethrone Roblox from games-as-a-platform throne?

The Predecessors: Who They Dethroned & Why

User-generated content (UGC) has a long lineage in gaming. In the 80s, titles like Pinball Construction Kit, Excitebike, and Wrecking Crew included level editors. The 1990s introduced more advanced tools, including scripting and asset imports in StarCraft’s “Use Map Settings” games, and the rise of supported mods in games like Doom and Half-Life.

The 2000s saw the rise of pure UGC games like LittleBigPlanet and Dreams, but these platforms failed to scale creator monetization. Later, games like DOTA2 and CS:GO tapped into community content for skin-based loot boxes, but kept creators in tightly curated, asset-only lanes. Even Minecraft’s DLC store, which has generated over $500 million to date, limited creators to selling small add-ons without enabling full-scale businesses.

Roblox changed that. It unified what others isolated: creation tools, monetization, advertising, and discovery, into one fully integrated ecosystem. The result isn’t just a game or a marketplace, but a self-sustaining UGC platform. In 2024 alone, Roblox generated $3.6 billion in revenue. It is the first ecosystem in gaming to mint teenage millionaires.

Roblox didn’t just dethrone UGC games. It bundled the engine, the store, an economy, and the audience into one vertical stack where competitors split them apart.

The Perfect Storm: Why Roblox Won

Roblox didn’t win because of technical superiority or an innovative economy. It won because it solved the hardest platform problem: the cold start. Launched in 2006, it took nearly a decade before Roblox gained traction. I interviewed at their HQ in 2012, six years after launch, and few in the industry including myself viewed it as a future industry titan. But over time, Roblox built a closed-loop creator economy, optimized for low-friction development, provided parent-friendly monetization, and obtained sticky retention from players and developers. That persistence gave them the deepest moat in games.

Like most two-sided platforms, Roblox serves both creators competing for user attention and users searching for the next hit experience. Its economy revolves around Robux, a premium currency that powers virtual item purchases and in-game transactions. Players can subscribe to Roblox Premium for a monthly Robux allowance, discounts, and access to advanced features like item trading. Developers monetize through revenue share from premium experience sales and a Developer Exchange that allows them to convert Robux into real-world income. The result is a closed-loop economy: fiat enters via player spending, circulates through platform-native systems, and exits through vetted creators with minimal leakage.

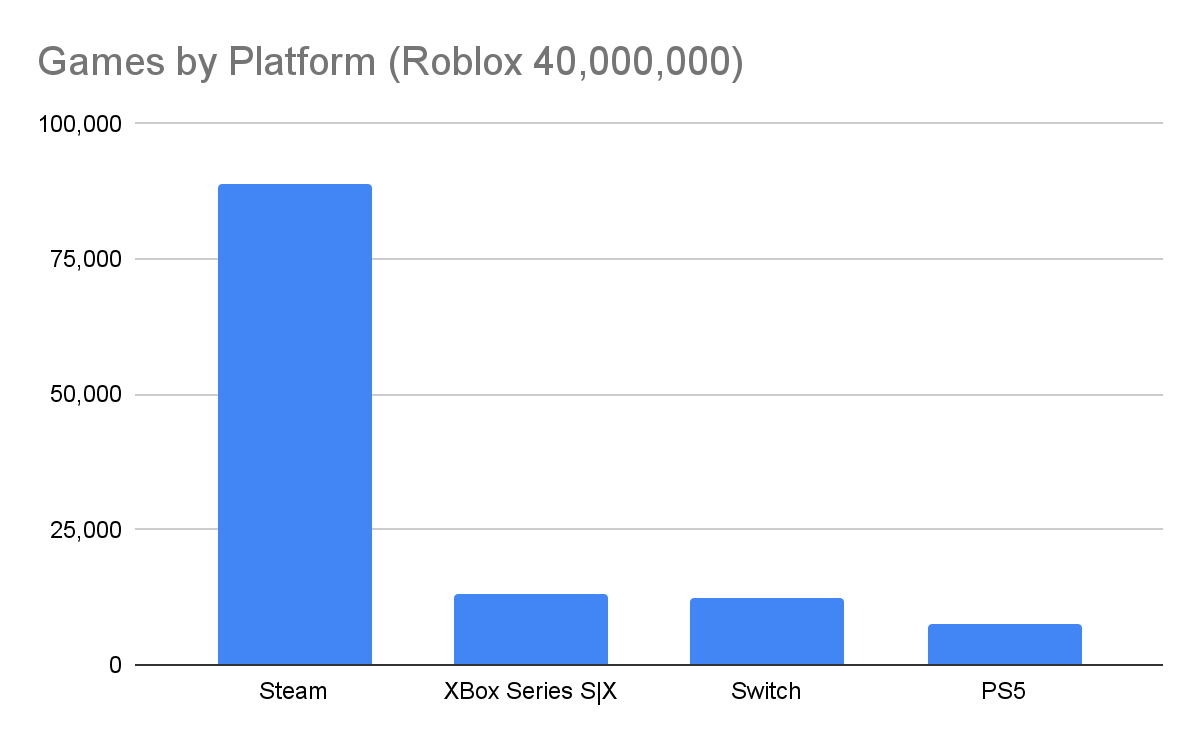

Roblox’s creator output thrives because the tool suite, Roblox Studio, and the asset store, Creator Store, lower the barrier to entry so low that children can build, test and publish games with no code and no funding. Such a low barrier to entry begets volume, an estimated 40 million games of volume (compared to an estimated 89k on Steam). Such a massive volume begets hit games, top Roblox games record over 10 billion visits. With hit games begets more developers pushing quality, top Roblox developers earn over $20 million annually. And so the flywheel spins.

Roblox’s monetization is designed with both players and parents in mind. With 45% of users under age 13, Roblox Premium subscription acts as a “safe drip” of currency that avoids impulsive spending. Meanwhile, parents can purchase assets and tools to support their child’s game development creativity, positioning Roblox Studio not just as a toy, but as a digital learning tool. For older players, the marketplace and asset trading system deepen retention and unlock status-seeking behaviors.

The cold start problem is what killed Roblox’s competitors. Meta’s Horizon Worlds has unlimited funding but no organic creator base. New UGC platforms like Core or Liminal launch without meaningful user demand. Even Fortnite, with its massive audience, hasn’t matched Roblox’s self-contained ecosystem. Roblox’s advantage wasn’t just tools, it was time. A decade of compounding creator activity met a once-in-a-generation pandemic surge, and the platform never looked back.

Why They Are Still on Top

Roblox is the platform burgeoning creators go to dip their toes in the game development waters. Roblox has retained all creators below the indie game level production because they are the only platform where significant revenue is generated for that level of game. Creators also retain because Roblox has cornered the younger video game demographic, having higher MAU than Nintendo. Having the healthiest creator resource allows Roblox to update their art, supported devices, and technology to keep ahead of competitors. This all cultivated with Roblox’s massive warchest through its fundraising ability and the largest IPO in video game history.

Roblox has become the default launchpad for aspiring game creators. By offering the only platform where games below the indie level can generate meaningful revenue, Roblox has retained developers that might otherwise focus on smaller efforts like game jams or mobile experiments. In 2024 alone, creators earned nearly $1 billion, more than some midsize game publishers. That kind of economic upside creates creator lock-in: developers don’t leave the platform that funds them and no other UGC platform can create millionaires with such minimal investment.

Roblox owns the under 13 gaming demographic. While most of the industry targets teens and adults, Roblox became the de facto platform for children, amassing an estimated 130 million MAU under 13. For developers and advertisers, that makes Roblox one of the most efficient platforms for building lifelong brand affinity with a younger demographic. For creators, it’s a renewable audience eager for fresh content and experimentation.

Roblox isn’t standing still. What began as low-fidelity voxel playgrounds now supports a range of visual styles and game types that rival AA-tier productions. Roblox Studio has matured into a development platform that supports multiplayer, persistence, scripting, monetization, and now AI tooling. This breadth of tools enables a breadth of games, from RPGs to educational games, to be developed natively for Roblox, and gives Roblox the genre surface area that platforms like Fortnite Creative still lack.

Finally, Roblox’s financial war chest puts it in a league of its own. With over $870 million raised pre-IPO and a historic $45.2 billion direct listing, Roblox now commands a $50 billion market cap, far outpacing its closest competitor, Fortnite Creative’s Epic Games. Roblox’s listing on the public market gives it access to equity financing not available to Epic Games. This capital advantage fuels creator tools, infrastructure, and marketing spend that reinforces its moat. Outside of Tencent and Microsoft, no other gaming company operates with that level of financial leverage.

The Challenger: Who (or What) Can Dethrone Them?

Incumbents aren’t toppled by incremental gameplay improvements. Most genre-defining franchises are eventually unseated not by feature-for-feature clones, but by innovations in audience reach, technology leverage, or monetization design. These are the three forces of disruption.

Audience Innovation

Redefining target audiences by utilizing targeting strategiesTechnology Innovation

Reinventing how games are built and played by utilizing emerging technologyBusiness Model Innovation

Reimagining how games generate revenue by utilizing alternative pricing strategies

Audience Innovations

Roblox has dominated the children and young adult demographics on the player side. On the creator side, Roblox has cornered the developers below the indie production value line and successfully converts a lot of players into their estimated 2.5 million creators. Roblox creates network effects that are family friendly and easy to learn but hard to leave. Though they seem immovable in their market position, their own moats can be a prison that limits their total addressable market, as platforms that target children rarely are compelling to adults.

Undifferentiated Targeting Roblox’s biggest advantage, its stranglehold over the younger demographics, is also its biggest disadvantage. Younger demographics generally don’t have disposable income and what purchases they can make are generally capped by their parent’s guidance. Creating a broader appealing ecosystem unlocks higher LTV players, which unlocks higher incentives for creators to push quality, which unlocks brand spend looking to appeal to high value users. A competitor can work its way down the age demographics similarly to how YouTube dominated general video media before creating a kids specific feature.

Segmented Targeting Roblox is a platform that tries to unlock as many different experiences as possible. This broadness allows for a competitor to hyper target a high development depth vertical such as RPGs, Gen Z focused narrative games, or social adventure games better than Roblox can with its broad suite of tools and assets. Become the platform for non-professional developers for a single vertical and once that vertical is conquered, start to expand to adjacent game-types.

Technology Innovation

Roblox has built a robust native technology stack including multiplayer support, developer analytics, and simple scripting that locks developers into its ecosystem of tools and assets. On the user side, Roblox has built an economic architecture that supports currencies, exchanges, quantity limited items, and item trading. This technology differentiates Roblox development and locks in both users and developers, but it also limits Roblox’s advances to its own scope.

Integration Strategy Roblox needs to develop its own tools internally and that keeps it from leveraging the wide range of specialized B2B and developer-focused products. Creating an integration model where developers can leverage their favorite tools and services into their UGC development seamlessly would unlock technology Roblox wouldn’t develop in another decade. Rather than waiting for Roblox to build new features internally, integrations allow the platform to evolve at the pace of the broader tech ecosystem. From the latest LLMs to modern social media coupling, developers could create modern cutting edge UGC experiences that would make Roblox look dated by comparison.

Metaverse Strategy Roblox is a bunch of disparate experiences where you have to join them through a central lobby system. Creating a persistence connected world where players never leave the game to travel to different experiences would make good on the longtime promise of a metaverse from sci fi novels such as Snowcrash and Ready Player One. The economics of pricing and how a shared currency is earned would provide developers guardrails on how to develop their own world to lure experience seeking players in. This strategy would make Roblox look like the technology of yesterday just as Roblox makes advanced level editors look outdated. With a focus on creators making compelling games, this strategy can succeed where more ambitious and less focused metaverses such as Meta’s Horizon Worlds failed.

Business Model Innovation

Roblox has mastered the closed loop ecosystem with its premium currency and how it enters through users at a single point and exits through developers at a single exchange. This allows Roblox to hyper control their economy both from a company yield standpoint and by limiting how player spend ends up as developer liquidity. But with this control comes constraints in both how players can support their favorite creators and how creators can offer compelling purchases that enhance their player’s experiences.

Direct Support Strategy Allow players to directly support their favorite creators through tools defined by the creator that unlock special supporter benefits. This is a common feature on social media platforms such as Twitch and Youtube, as well as funding platforms like Kickstarter or creator support platforms like Patreon. Developers can further build a relationship with their players, increasing player retention and building their audience through their evangelical fan’s word of mouth. Players can support their favorite developers by providing more consistent income and build a relationship with that developer through unlocked features, communication, supporter-only content, and physical merchandise.

Decentralized Economy Strategy Rather than having a central currency tightly controlled by the platform holder, allow developers to create their own currency and value it in an open market against other developers. Creators can band together under one currency like the European Union, or send their currency through an inflationary spiral by over-minting new coins while not having enough sinks to offset the generation. This hands over more controls to developers to not only craft their experiences but the entire ecosystem within their games. For players, this creates an interesting depth that once understood, enables more reasons to choose an experience besides what’s hot right now. This would allow a subset of players to correct the market through similar tools available to market makers today. There is a risk of manipulation and speculation not unlike the currency crypto market, but it would add to the drama and interest in the platform.

Roblox’s strength is their dominance with the children and young adult market, their developer locking native technology stack, and their closed loop economy that gives them control over the inflow and outflow of premium currency. These strengths also represent structural constraints. Targeting a broader market, giving developers the ability to integrate their preferred technology, connect experiences across a single persistent world, and allow developers to own their relationship with players through funding options would not only entice the most successful Roblox creators but also give players an experience that makes this platform feel like a new evolution of UGC platforms. The platform that dethrones Roblox won’t compete game-for-game, it will reimagine what a UGC platform can be in a fully connected, creator-first economy.

What This Means for the Industry

Roblox has shown the game industry that turning players into creators and leveraging the creativity of your community can build incredible platforms that dwarf the biggest publishers and console makers. By targeting an underserved demographic, reducing friction in development, building a trusted economic loop, and continuously evolving its technology stack, Roblox didn’t just create a hit game, it became the most-played platform in gaming and the largest IPO in industry history.

Its success has reshaped the strategies of competitors like Fortnite, which now invests heavily in UGC to replicate Roblox’s creator-driven model. Roblox also demonstrated that category-defining platforms aren’t always built on cutting-edge tech or viral marketing, they're built through persistence, long-term capital, and structural innovation.

The question now is whether Roblox can continue scaling up to meet the expectations of an older, more demanding audience or whether a new platform will emerge to do to Roblox what it once did to modding communities and advanced level editors. Will Roblox age up and become the YouTube of games or be replaced by a platform native to Gen Alpha’s needs?